Predictive analytics is transforming all kinds of industries. It can catch fraud before it happens, turn a small-fry enterprise into a titan, and even save lives.

Most applications typically talk about what happened in the past. But end users are looking for new ways to leverage their business data. They want to know what is most likely to happen in the future—and, even more importantly, identify actions they can take to make good things happen and prevent bad things from happening.

The opportunities are endless—and it often starts with a little inspiration. Read on to explore five end-to-end examples of how predictive analytics works for five very different industries:

Healthcare

Improving Patient Outcomes

Problem: Data growth affects every industry today—and healthcare data is primed to grow faster than nearly any other market, according to a recent report from the International Data Corporation (IDC). As healthcare data explodes in volume, the popularity of machine learning and predictive analytics grows. There are three key areas in which machine learning can help healthcare organizations: improving patient outcomes, improving healthcare operations, and detecting fraud.

In this case, say we have 1,000 patients who need to be screened for diabetes. Is there a way to prioritize high-risk patients for screenings first, and de-prioritize low-risk patients to be screened later?

Benefits: By predicting which patients are high-risk, predictive analytics ensures patients who need care urgently are able to get it faster. At the same time, healthcare practitioners can be more efficient with their time and resources.

Data to Analyze: The predictive analytics model should consider data from many sources, including patient demographics, patient vitals, past medication history, visits to the hospital, lab test results, and any claims data.

Actions to Take: Patients found to be at a higher risk of the condition will be notified to come in for a screening sooner rather than later.

Embedding predictive analytics into your existing systems is key here. By putting future insights and recommended actions in the applications your people already use, you empower them to make more informed decisions without jumping into another system.

Discover more examples of how predictive analytics helps the healthcare industry in the on-demand webinar: Predictive Analytics for Healthcare.

Manufacturing

Predictive Maintenance

Problem: For manufacturers, equipment failure can mean business failure. Machine downtime can cost millions of dollars a year in lost profits, repair costs, and lost production time for employees.

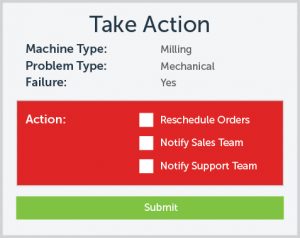

Benefits: By embedding predictive analytics in their applications, manufacturing managers can monitor the condition and performance of equipment and predict failures before they happen. They can plan ahead and reallocate the load to other machines to reduce any impact on production.

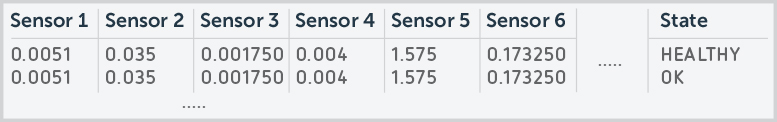

Data to Analyze: Data may include maintenance data logs maintained by the technicians, especially for older machines. For newer machines, data coming in from the different sensors of the machine—including temperature, running time, power level durations, and error messages—will be very useful.

You can use a few different predictive techniques to teach your model how to flag machines that may need attention soon:

- Map sensor readings against the actual state of machines. In this approach, you run a simple clustering algorithm (K-means) to see if sensor values from different machines can logically put those machines into three different groups, then compare the groupings created by the algorithm with the actual states of the machines. Ideally, the outcome for the groups generated by the algorithm will match the reality, and you can apply the model to predict future states with relative accuracy.

- Identify correlations between sensors. Predictive analytics models may be able to identify correlations between sensor readings. For example, if the temperature reading on a machine correlates to the length of time it runs on high power, those two combined readings may put the machine at risk of downtime.

- Predict future state using sensor values. Since the machine status is a known value, you can run a classification algorithm (for example, Gradient Boosted Model) to create a predictive model that predicts the state of the machine based on sensor values. This model can be subsequently used to predict and flag the state of machines based on the combination of new sensor values.

Actions to Take: Once you have trained your predictive model, you can use it to determine the likelihood of breakdowns. Plan ahead to shut machines down for preventive maintenance as needed. You can also use predictive analytics to limit or prevent any impact on your production pipeline. By knowing which machines will go down and when, you can identify another machine or manufacturing shop that can pick up the missed load so your business doesn’t slow down.

Finance

Predicting Late Payments

Problem: Whether you work at a bank or in accounting for a business, any finance professional knows how much of a disruption missed payments can be. Financial groups with outstanding invoices need to know who will—and who will not—pay their bills on time.

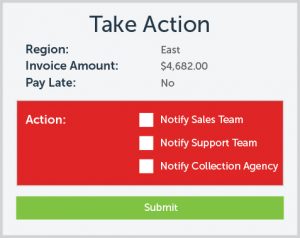

Benefits: By predicting which individuals or businesses will likely miss their next payment, financial groups can better manage cashflow. They can also take steps to mitigate the problem by sending reminders to potential late payers.

Data to Analyze: The predictive analytics solution can analyze company or individual demographics, products they purchased/used, past payment history, customer support logs, and any recent adverse events.

Actions to Take: Once the financial group knows who is likely to pay their bills late, they can send payment reminders. Predictive analytics can recommend the best date and time to send reminders, as well as the best mode of contact (for example, text message, email, or phone call). The group may also be able to offer individuals other payment options, such as a delayed payment plan.

Insurance

Preventing Fraud

Problem: Many creative tactics can be used to commit insurance fraud, including staged incidents, withholding or falsifying information, and making fraudulent transactions.

Benefits: Insurance companies can use predictive analytics technology to track and monitor potential scammers, without spending time sorting through every claim.

Data to Analyze: The predictive analytics algorithm can consider the location where the claim originated, time of day, claimant history, claim amount, and even public data such as the National Fraud Database.

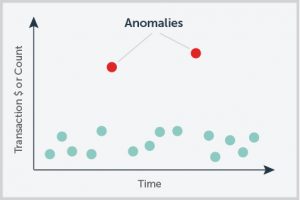

Actions to Take: By applying the model to new claims, insurance companies can quickly detect suspicious activity. Any claim that appears abnormal is marked as an outlier. Claims that are likely to be fraudulent will be put on hold and sent back to investigators for further review. Potential alerts can also be cross-referenced with information in public registers, like the National Fraud Database, to reduce the likelihood of false leads accompanying legitimate ones.

Investigators can use the analysis to refine their approaches to fraud. And because the patterns may reveal new types of risk, insurance companies can add new threats to their watch lists as well.

SaaS

Reducing Customer Churn

Problem: Customer churn has always been a difficult metric to understand for SaaS (Software as a Service) companies. Most churn applications tell you how many customers churned last month and how much money was lost. But they fail to find correlations to tell you what kinds of customers are likely to churn.

Benefits: With predictive analytics, product managers can forecast and mitigate churn with much more precision than typical analytics tools—which can lead to significant revenue. Say your enterprise SaaS company has an average churn rate of 1 percent per month (12 percent per year). If you’re at $30M ARR, you are churning close to $4.5M per year. If you reduce churn by just 2 percent a year, you can save close to half a million dollars.

Data to Analyze: The predictive analytics algorithm should consider customer demographics, products purchased, product usage, customer calls, time since last contact, past transaction history, industry, company size, and revenue.

Actions to Take: Actions may include an automated email showing the customer how they can get more value from the application, or a trigger to the customer success team to proactively get in touch to understand what can be done to help the customer.

It’s not only important to identify who will churn, but also who will not churn. Predicting which customers will not churn means you can find different ways to engage them with new products or strategic partnerships.

accompanying legitimate ones.

Conclusion

There is no limit to the number of industries or situations in which predictive analytics can help. Whether you’re looking to keep your customer churn rate low, bolster your company’s fraud detection, or make your manufacturing process run smoothly, look to predictive analytics.